There are several steps you can take to learn about business accounting and taxation:

Determine your learning goals: Before enrolling in any course, you should have a clear understanding of what you hope to achieve. Do you want to learn about basic accounting principles, tax laws, or both? Knowing your learning goals can help you find the right course to suit your needs.

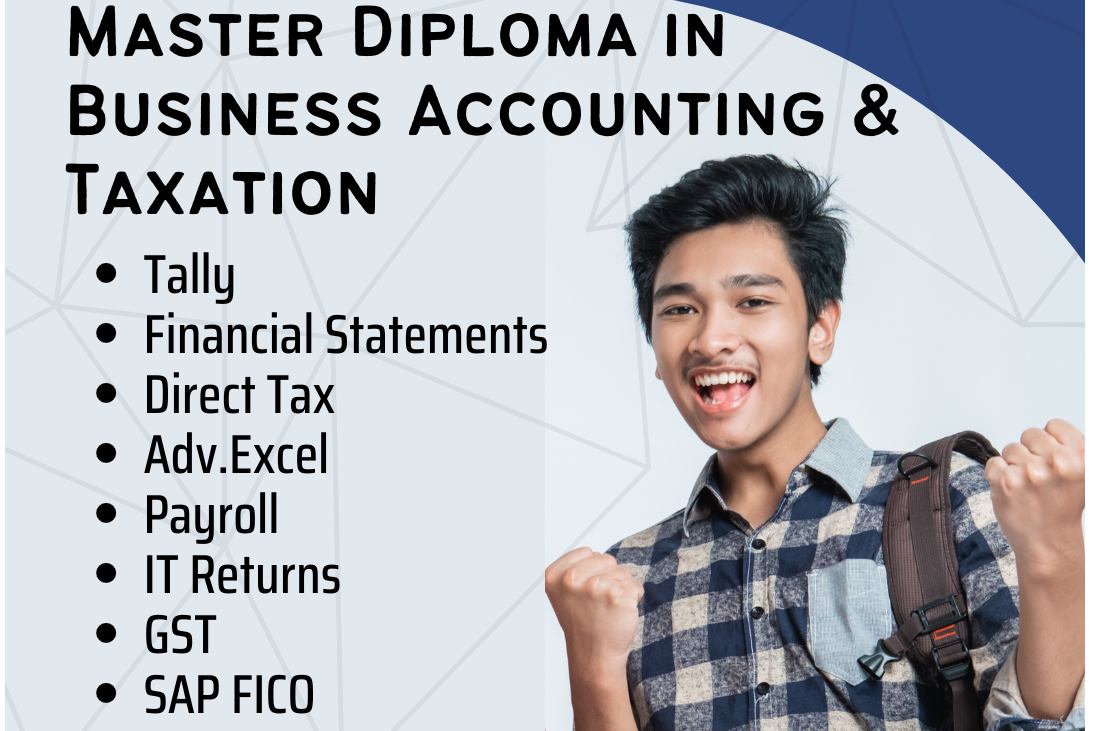

Choose a course: There are many options for business accounting and taxation courses, both online and in-person. In Tally Training Chennai Institute for courses that cover the topics you want to learn, are taught by experienced professionals, and offer practical examples and exercises.

Learn the basics of accounting: If you're new to accounting, you may want to start with the basics, such as understanding financial statements, tracking income and expenses, and managing cash flow.

Study tax laws: Tax laws can be complex and change frequently, so it's important to stay up-to-date on the latest regulations. Look for courses that cover both federal and state tax laws, and provide real-world examples to help you understand how to apply them.

Practice, practice, practice: Accounting and taxation require a lot of practice to master. Look for courses that offer hands-on exercises, case studies, and simulations that allow you to practice what you've learned.

Seek professional certification: Once you've completed a course, consider seeking professional certification in accounting or taxation. This can help demonstrate your knowledge and expertise to employers or clients.

Stay up-to-date: Accounting and taxation laws and regulations are constantly changing, so it's important to stay current with the latest developments. Consider subscribing to industry publications, attending conferences or webinars, or taking continuing education courses to stay up-to-date.